inheritance tax proposed changes 2021

Baker had proposed in January about 700 million worth of cuts to the tax code. The proposed impact will effectively increase estate and gift tax liability significantly.

Pin By Terry Wilson On Wilson Inheritance In 2022 Revocable Living Trust Planning Guide How To Plan

The legislation would lower the federal estate tax exemption level from 117 million to 35 million per individual resulting in a larger number of estates owing estate tax.

. Inheritance tax is a popular thing in recent timesYou must know how your loved ones assets will be divided to figure out how inheritance tax worksThe estate executor will divide the assets among the inheritors but you must remember to pay inheritance tax as well even if the state where the person lived was exemptTypically inheritance tax is calculated based on the. Since 2018 estates are only taxed once they exceed 117 million for individuals. Japans 2021 tax reforms include minor changes to the scope of inheritance and gift tax for non-Japanese nationals in an effort to increase the attractiveness of Japan as a financial hub.

The exemption is the. The 995 Act would also establish a new progressive estate tax rate structure that would tax 45 of the value of an estate from 35-10 million 50 of the value of an. This could result in a significant increase in CGT rates if this recommendation is implemented.

234 million for married couples at. Under current law the existing 10 million exemption would revert back to the 5 million exemption. For exempt estates the value limit in relation to the gross.

The Treasury Green Paper is expected to include many of the proposed corporate tax changes in the Obama administrations 2017 fiscal budget released on February 9 2016. For the vast majority of Americans the federal estate tax the death tax has been a non-issue since 2010 when the exemption was raised to 5 million and indexed for inflation. Proposed changes to inheritance tax could impact county revenue property taxes Brandon Summers Feb 27 2021.

His plan cleared the Houses Revenue committee without a vote against it but pared down to about 600 million. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million indexed for inflation to roughly 62 million as of January 1 2022. One pending proposal is to raise the capital gains tax to 396 for taxpayers with income in excess of 1000000 for taxpayers filing jointly and 500000 for taxpayers filing separately.

The current rate is an estate tax exemption of 11700000 per person 2340000 per married couple. The changes in tax rates could be as follows. Reduce the current 117 million federal ESTATE tax exemption to 35 million.

Proposed changes to Capital Gains Tax. House Democrats on Monday revealed a package of tax hikes on corporations and the rich without President Joseph Biden s proposed levy on. The proposed 396 top capital gains tax rate would match a separate proposal to raise the highest individual income tax rate from 37 to 396 which was.

Read on for five of the most significant proposed changes. The first is the federal estate tax exemption. More farms businesses and estates are expected to be taxed under Mr.

10 on assets 18 on property. Estate tax applies at the federal level but very few people actually have to pay it. Meaning estates under 1158 millionpossibly a LOT less than 1158 millioncould be subject to these taxes.

In 2018 in response to sentiment from the domestic industry a new category called temporarily domiciled foreigner was introduced to reduce the scope. The tax kicks in when the deceased has a net worth of 117 million or more and it applies a 40 tax. The Biden campaign is proposing to reduce the estate tax exemption to 3500000 per person 7000000 per married couple.

20 on assets and property. There are signs that the Federal exemption for estate taxes may be lowered in 2021. In 2022 there is an estate tax exemption of 1206 million meaning you dont pay estate tax unless your estate is worth more than 1206 million.

Recently the Agricultural and Food Policy Center at Texas AM University developed a study showing. This is approximately a 70. The limit for chargeable trust property is increased from 150000 to 250000.

The tax rate on the estate of an individual who passes away this year with an estate valued over the 1158 million exemption is also a flat 40. The STEP Act announced by Senator Van Hollen proposes to eliminate stepped-up basis upon the death of the owner and the 995 Percent Act introduced by Senator Sanders decreases the estate tax exemption down significantly from where it is today. Kane a 3-year-old Belgian malinois joined.

The exemption was 117 million for 2021 Even then youre only taxed for the portion that exceeds the. The Obama administrations budget included more than 140 tax proposals including the repeal of the last-in last-out LIFO inventory accounting method.

Pin By Tri City Association Of Realto On Tcar Classes Events Tax Reduction Register Online Learning

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Only State To Inheritance Tax Estate Tax States

It May Be Time To Start Worrying About The Estate Tax Published 2021 Estate Tax Capital Gains Tax How To Raise Money

Tax Proposals Comparisons And The Economy Tax Foundation

Marijuana Taxes Tax Foundation

Proposed Estate Tax Change May Require You Take Action In 2021 Youtube Estate Planning Checklist How To Plan Estate Tax

State Corporate Income Tax Rates And Brackets Tax Foundation

Marijuana Taxes Tax Foundation

2015 2021 Form Irs 8822 Fill Online Printable Fillable Blank Pdffiller Money Template Change Of Address Irs

From Brother Iprint Scan Sheet Music Scan Music

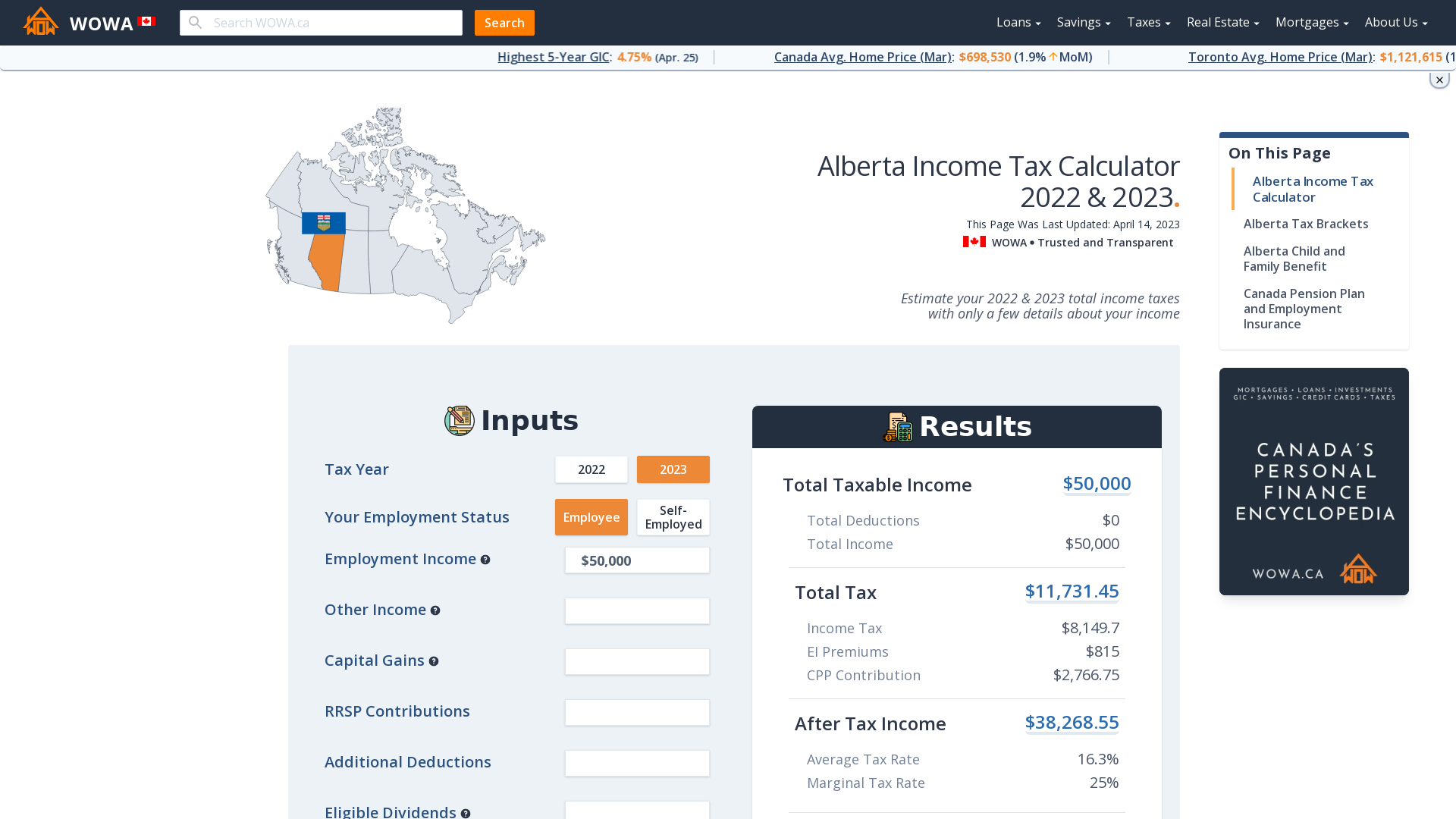

Canada Capital Gains Tax Calculator 2021 Nesto Ca

4 Dave Ramsey Rules We Broke And Still Paid Off 71k Of Debt Easy Budget Budgeting Debt Simple Budget